Press Releases

LQWD News

- October 20, 2021

LQwD Announces Marketed Public Offering

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

Lightning Network focused company, LQwD FinTech Corp. (TSXV: LQWD, OTC: LQWDF) is pleased to announce that it is commencing a marketed offering (the “Offering”) of units (the “Units”) of the Company. Each Unit will consist of one common share (a “Common Share”) and one-half of one common share purchase warrant of the Company (each whole such warrant, a “Warrant”), with each Warrant being exercisable to acquire one additional common share of the Company (a “Warrant Share”). The Offering is being conducted by a syndicate of underwriters (the “Underwriters”) led by Canaccord Genuity Corp. as lead underwriter.

The Offering is expected to be priced in the context of the market, with the final terms of the Offering to be determined at the time of pricing. There can be no assurance as to whether or when the Offering may be completed, or as to the actual size or terms of the Offering. The closing of the Offering will be subject to market and other customary conditions, including approval of the TSX Venture Exchange (the “TSXV”).

The Company has granted the underwriters an option (the “Over-Allotment Option”), exercisable at any time for a period of 30 days after and including the closing of the Offering, to purchase up to an additional 15% of the Units sold pursuant to the Offering on the same terms and conditions of the Offering. The Over-Allotment Option may be exercisable to acquire Units, Common Shares and/or Warrants (or any combination thereof) at the discretion of the underwriters.

The Units will be offered in each of the provinces and territories of Canada, other than Québec, pursuant to a prospectus supplement to the Company’s short form base shelf prospectus dated September 15, 2021 (the “Prospectus”) and in the United States on a private placement basis to “accredited investors” meeting one or more of the criteria in Rule 501(a) of Regulation D under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) and to “Qualified Institutional Buyers” pursuant to the registration exemptions provided by Rule 144A of the U.S. Securities Act.

The net proceeds from the Offering will be used for general corporate and working capital purposes.

In consideration for their services, the Company will pay the Underwriters a cash fee equal to 7.0% of the aggregate gross proceeds of the Offering. The Underwriters will also be granted such number of compensation warrants (each, a “Compensation Warrant”) as is equal to 7.0% of the aggregate number of Units issued pursuant to the Offering. Each Compensation Warrant will be exercisable to acquire one common share of the Company (a “Compensation Warrant Share”) at an exercise price equal to the issue price of the Units (the “Offering Price”) for a period of 24 months from the closing of the Offering, subject to adjustment in certain events. The Company is entitled to designate certain subscribers to be included in the Offering (the “President’s List”). The cash fee and Compensation Warrants payable for President’s List orders will be reduced to 3.5% and 3.5% respectively.

The Company has applied to list the Common Shares, Warrant Shares and Compensation Warrant Shares issuable pursuant to the Offering on the TSXV. Copies of the Prospectus, following filing thereof, can be obtained on SEDAR at www.sedar.com and from Canaccord Genuity Corp., 2100, 609 Granville St, Vancouver BC V7Y 1H2. The Prospectus contains important detailed information about the Company and the proposed Offering. Prospective investors should read the Prospectus and the other documents the Company has filed on SEDAR at www.sedar.com before making an investment decision.

No securities regulatory authority has either approved or disapproved of the contents of this press release. The Units, Common Shares, Warrants and Warrant Shares have not been and will not be registered under the U.S. Securities Act or any state securities laws. Accordingly, the securities described herein may not be offered or sold within the “United States” or to, or for the account or benefit of, a person in the “United States” or a “U.S. person” (as such terms are defined in Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to exemptions from the tregistration requirements. This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities of LQwD in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About LQwD

LQwD is a Lightning Network Service Provider (LSP) focused company developing payment infrastructure and solutions. The Company\’s mission is to develop institutional grade services that support the Lightning Network and drive improved functionality, transaction capability, user adoption and utility and scaling Bitcoin. LQwD also holds Bitcoin as an operating asset establishing nodes and payment channels across the Lightning Network.

For further information:

Ashley Garnot

Corporate Development

Phone: 1.604.669.0912

Email: [email protected]

Website: www.lqwdfintech.com

Forward-Looking Statements

This news release contains \”forward-looking information\” within the meaning of applicable securities laws. All statements, other than of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding to the Offering generally, the terms thereof, the use of the net proceeds thereof, the exercise of the Over-Allotment Option and the satisfaction of the conditions of the closing of the Offering, including the receipt, in a timely manner, of required approvals) are forward-looking statements. Forward-looking statements are generally identifiable by use of the words “may”, “will”, “should”, “continue”, “expect”, “anticipate”, “estimate”, “believe”, “intend”, “plan” or “project” or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are disclosed in the Company’s public disclosure record on file with the relevant securities regulatory authorities, many of which are beyond the Company\’s ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate, that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. Actual results and developments may differ materially from those contemplated by these statements. The statements in this press release are made as of the date of this release and the Company assumes no responsibility to update them or revise them to reflect new events or circumstances other than as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

- October 13, 2021

LQwD to Provide BIGG with Bitcoin Lightning Network Capability; LQwD Selects BIGG Digital Assets as Preferred Liquidity Partner and Compliance Software Provider

LQwD Fintech Corp. (TSXV: LQWD, OTC: LQWDF), is pleased to announce that it has entered into a strategic services agreement with Netcoins Inc. (“Netcoins”), a leading Canadian crypto trading platform and subsidiary of BIGG Digital Assets Inc. (“BIGG”) (CSE: BIGG).

Under the agreement, Netcoins will establish a node on the Bitcoin Lightning Network via LQwD’s proprietary Lightning PaaS (Platform as a Service) software. This marks the first institutional grade Lightning payment channel for Netcoins and BIGG.

Netcoins will also serve as preferred liquidity provider for LQwD’s wholly owned virtual currency platform, Coincurve.com. Additionally, BIGG’s Blockchain Intelligence Group (Blockchaingroup.io), and Netcoins’ affiliate, will provide Coincurve and LQwD’s Lightning Network Platform with a suite of institutional and government grade compliance software, including BitRank® and QLUE™.

Mark Binns, BIGG’s CEO, remarked, “As the only publicly owned and regulated crypto trading platform in Canada, becoming the liquidity partner for LQwD makes perfect sense. We can offer LQwD industry leading rates as an institutional customer, and bundle BitRank® and QLUE™ blockchain tech for a complete package. Correspondingly, we are thrilled to establish a node with LQwD on the fast-growing Lightning Network.\”

Shone Anstey, CEO of LQwD, commented, “We are grateful to have a strong relationship with Netcoins and Blockchain Intelligence Group as we expand our footprint in the rapidly emerging Bitcoin Lightning Network. LQwD can now leverage BitRank® and QLUE™ for our AML needs and route crypto purchases for Coincurve.com and additional platforms through Netcoins, Canada\’s first publicly traded, licensed crypto trading platform. It also allows Netcoins to have an early mover advantage in the Canadian markets for handling instant deposits and withdrawals of Bitcoin via LQwD’s Bitcoin Lightning Network platform.\”

About the Lightning Network

The Lightning Network is a solution to mass scaling the usage of Bitcoin for microtransactions globally, dramatically improving upon fees, as well as instant settlement times. The Lightning Network has experienced explosive growth in the past 90-days with node growth doubling and Lightning Network BTC capacity increasing 51.74%. Some well-known companies such as Jack Dorsey’s Twitter and Square have expressed their enthusiasm to incorporate Lightning Network into their platforms.

About LQwD Fintech Corp.

LQwD is a Lightning Network focused company developing payment infrastructure and solutions. The Company’s mission is to develop institutional grade services that support the Lightning Network and drive improved functionality, transaction capability, user adoption and utility and scaling Bitcoin. LQwD also holds Bitcoin as an operating asset establishing nodes and payment channels across the Lightning Network.

About BIGG Digital Assets Inc.

BIGG Digital Assets Inc. (BIGG) believes the future of crypto is a safe, compliant, and regulated environment. BIGG invests in products and companies to support this vision. BIGG owns two operating companies: Netcoins (netcoins.ca) and Blockchain Intelligence Group (blockchaingroup.io).

Netcoins develops brokerage and exchange software to make the purchase and sale of cryptocurrency easily accessible to the mass consumer and investor with a focus on compliance and safety. Netcoins utilizes BitRank Verified® software at the heart of its platform and facilitates crypto trading via a self-serve crypto brokerage portal at Netcoins.app.

Blockchain Intelligence Group is a global developer of blockchain technology building a secure future. Financial institutions and crypto companies depend on its technology to monitor risk from crypto transactions. Investigators and law enforcement quickly identify and track illicit activity. The crypto forensics technology was designed by investigators for investigators. Blockchain Intelligence Group is trusted globally by leading financial institutions, crypto companies, Fintech, Regtech, law enforcement and regulators.

For further information:

Ashley Garnot, Corporate Development

Phone: 1.604.669.0912

Email: [email protected]

Website: www.lqwdfintech.com

Forward-Looking Statements

This news release contains \”forward-looking information\” within the meaning of applicable securities laws relating to the Company’s business plans and the outlook of the Company’s industry. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate, that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. Actual results and developments may differ materially from those contemplated by these statements. The statements in this press release are made as of the date of this release and the Company assumes no responsibility to update them or revise them to reflect new events or circumstances other than as required by applicable securities laws. The Company undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of the Company, LQwD, their securities, or their respective financial or operating results (as applicable).

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

- October 5, 2021

LQwD Announces Launch of Lightning Network Routing Nodes and Deployment of Bitcoin into Payment Channels

Lightning Network focused company, LQwD FinTech Corp. (TSXV: LQWD, OTC: LQWDF) announces that it has established routing nodes and has deployed Bitcoin into payment channels on the Lightning Network, providing essential liquidity to support the significant growth over the past year of the Lightning Network (LN).

This milestone is the first stage in the Company\’s Lightning Network platform becoming operational, providing infrastructure, solutions, and liquidity to support the development of the network and earning fees in the process.

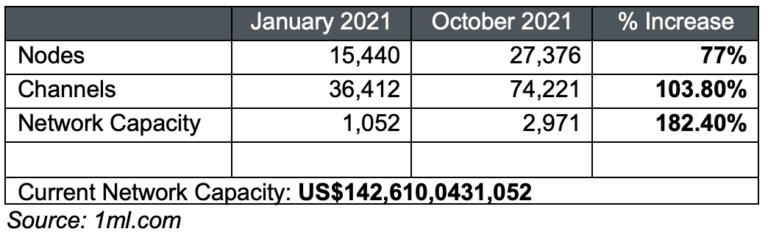

The Lightning Network, a layer 2 payment protocol built on top of the Bitcoin blockchain, is composed of nodes (computers) running the LN software, connected to other nodes via payment channels allowing them to forward payments on the way to their final destination (payment recipient). Every payment channel needs enough Bitcoin on them for a payment to go through. LQwD, as an LSP or Lightning Network Services Provider, stakes its Bitcoin on routing nodes to help ensure the functioning of the network where fees can be earned for forwarding transactions. The Company believes this growth, shown through the increased number of nodes, payment channels and overall network capacity, will continue. The Company intends to establish as large of a footprint as possible in order to capture transaction fees as network volume grows.

Recent use cases of the utility of the Lightning Network have been demonstrated in El Salvador through mainstream merchants such as McDonalds and Starbucks using it for payment, as well as Twitter enabling it for tipping on their global social media platform with 200 million daily active users.

Demonstrable growth of the Lightning Network since January 1, 2021:

For more information on the Lightning Network, please visit LQwDFintech.com or LQwDFintech.com/node-stats/.

About LQwD

LQwD is a Lightning Network Service Provider (LSP) focused company developing payment infrastructure and solutions. The Company\’s mission is to develop institutional grade services that support the Lightning Network and drive improved functionality, transaction capability, user adoption and utility and scaling Bitcoin. LQwD also holds Bitcoin as an operating asset establishing nodes and payment channels across the Lightning Network.

For further information:

Ashley Garnot, Corporate Development

Phone: 1.604.669.0912

Email: [email protected]

Website: www.lqwdfintech.com

Forward-Looking Statements

This news release contains \”forward-looking information\” within the meaning of applicable securities laws relating to the Company\’s business plans and the outlook of the Company\’s industry. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate, that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. Actual results and developments may differ materially from those contemplated by these statements. The statements in this press release are made as of the date of this release and the Company assumes no responsibility to update them or revise them to reflect new events or circumstances other than as required by applicable securities laws. The Company undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of the Company, LQwD Financial, their securities, or their respective financial or operating results (as applicable).

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

- September 16, 2021

LQwD Provides Corporate Update

Lightning Network focused company, LQwD Fintech Corp. (TSXV: LQWD, OTC: LQWDF) is pleased to announce that it has filed a final short form base shelf prospectus (the “Final Shelf Prospectus”) with the securities commissions in each of the provinces and territories of Canada, except Québec.

The Final Shelf Prospectus allows the Company to offer and issue up to $50 million of common shares, warrants, subscription receipts, units, debt securities or any combination of such securities (collectively, the \”Securities\”) during the 25-month period that the Final Shelf Prospectus is effective. The Securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of sale, which will be set forth in a prospectus supplement to be filed.

The Securities have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the Securities in any State or jurisdiction in which such offer, solicitation or sale would be unlawful.

A copy of the Final Shelf Prospectus is available under the Company’s profile on SEDAR (www.sedar.com).

About the Lightning Network

The Lightning Network is a solution to mass scaling the usage of Bitcoin for microtransactions globally, dramatically improving upon fees, as well as instant settlement times. The Lightning Network has experienced explosive growth in the past 90-days with node growth doubling and Lightning Network BTC capacity increasing 51.74%. Some well-known companies such as Jack Dorsey’s Twitter and Square have expressed their enthusiasm to incorporate Lightning Network into their platforms.

About LQwD Fintech Corp.

LQwD is a Lightning Network focused company developing payment infrastructure and solutions. The Company’s mission is to develop institutional grade services that support the Lightning Network and drive improved functionality, transaction capability, user adoption and utility and scaling Bitcoin. LQwD also holds Bitcoin as an operating asset establishing nodes and payment channels across the Lightning Network.

For further information:

Ashley Garnot, Corporate Development

Phone: 1.604.669.0912

Email: [email protected]

Website: www.lqwdfintech.com

Forward-Looking Statements

This news release contains forward-looking statements regarding potential financings pursuant to the Final Shelf Prospectus and the filing of one or more prospectus supplements. These forward-looking statements are provided as of the date of this news release, or the effective date of the documents referred to in this news release, as applicable, and reflect predictions, expectations or beliefs regarding future events based on the Company\’s beliefs at the time the statements were made, as well as various assumptions made by and information currently available to them. In making the forward-looking statements included in this news release, the Company has applied several material assumptions, including, but not limited to, the assumption that regulatory approval of any shelf prospectus filings and related offerings will be obtained in a timely manner; that general economic and business conditions will not change in a materially adverse manner; and that the Company will be able to raise funds on reasonable terms. Although management considers these assumptions to be reasonable based on information available to it, they may prove to be incorrect. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions on which they are based do not reflect future experience. We caution readers not to place undue reliance on these forward-looking statements as a number of important factors could cause the actual outcomes to differ materially from the expectations expressed in them. These risk factors may be generally stated as the risk that the assumptions and estimates expressed above do not occur, but specifically include, without limitation, risks relating to: general market conditions; the Company\’s ability to secure financing, on favourable terms, pursuant to the Final Shelf Prospectus and any prospectus supplements; and the additional risks described in the Final Shelf Prospectus and the Company\’s Annual Information Form, and other disclosure documents filed by the Company on SEDAR. The foregoing list of factors that may affect future results is not exhaustive. When relying on our forward-looking statements, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by the Company or on behalf of the Company, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

- September 2, 2021

LQwD Provides Corporate Update

Lightning Network focused company, LQwD Fintech Corp. (TSXV: LQWD, OTC: LQWDF) is pleased to provide the following corporate highlights since the Company completed the acquisition of LQwD Financial Corp. on June 9, 2021:

- advances in the development of the Lightning Network SaaS platform having achieved the milestone of establishing LSP services, payment channels and watchtowers, as well as launching beta testing of the platform;

- adding highly qualified engineers and strategic advisors to the team, including: Joost Jager, a Lightning Infrastructure Engineer with a M.Sc. in CS and specialization in artificial intelligence; and Roy Sheinfeld, co-founder and CEO of Breez Technology Inc., a privately-held company that combines an LSP, point-of-sale app for merchants, and non-custodial end-user app;

- the cumulative purchase of over C$3 million worth of Bitcoin at an average price of C$46,000;

- filed a preliminary short form base shelf prospectus that when final will allow LQwD to offer and issue up to $50 million of common shares, warrants, subscription receipts, units, debt securities, or any combination of such securities during the 25-month period that the prospectus is effective; and

- the grant of 3,325,000 stock options exercisable for a period of five years at a price of C$0.60 per share to various directors, officers, employees and consultants. The stock options will be subject to deferred vesting over two years and is part of LQwD’s ongoing strategy of granting stock options to attract and retain talent, as well as motivating its team.

Shone Anstey, LQwD’s CEO commented, “We are very pleased with the progress that our team has made since completing the transaction in June. Using our highly skilled in-house team, we are continuing to develop a Lightning Network SaaS platform that enables the set-up of payment channels as a service. LQwD’s Lightning Network SaaS platform is at an advanced level of development, with beta testing having commenced in the second half of 2021. We look forward continuing along this growth trajectory and maximizing shareholder value in the process.”

About the Lightning Network

The Lightning Network is a solution to mass scaling the usage of Bitcoin for microtransactions globally, dramatically improving upon fees, as well as instant settlement times. The Lightning Network has experienced explosive growth in the past 90-days with node growth doubling and Lightning Network BTC capacity increasing 51.74%. Some well-known companies such as Jack Dorsey’s Twitter and Square have expressed their enthusiasm to incorporate Lightning Network into their platforms.

About LQwD Fintech Corp.

LQwD is a Lightning Network focused company developing payment infrastructure and solutions. The Company’s mission is to develop institutional grade services that support the Lightning Network and drive improved functionality, transaction capability, user adoption and utility and scaling Bitcoin. LQwD also holds Bitcoin as an operating asset establishing nodes and payment channels across the Lightning Network.

For further information:

Ashley Garnot, Corporate Development

Phone: 1.604.669.0912

Email: [email protected]

Website: www.lqwdfintech.com

Forward-Looking Statements

This news release contains \”forward-looking information\” within the meaning of applicable securities laws relating to the Company’s business plans and the outlook of the Company’s industry. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate, that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. Actual results and developments may differ materially from those contemplated by these statements. The statements in this press release are made as of the date of this release and the Company assumes no responsibility to update them or revise them to reflect new events or circumstances other than as required by applicable securities laws. The Company undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of the Company, LQwD, their securities, or their respective financial or operating results (as applicable).

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

- July 27, 2021

LQwD Files Preliminary Base Shelf Prospectus

Lightning Network focused company, LQwD Fintech Corp. (TSXV: LQWD, OTCQB: LQWDF) is pleased to announce that it has filed a preliminary short form base shelf prospectus with the securities commissions in each of the provinces and territories of Canada, except Quebec.

The base shelf prospectus (the “Shelf Prospectus”) has not yet become final for the purpose of the sale of any Securities (as defined herein). When final, the Shelf Prospectus will allow LQwD to offer and issue up to $50 million of common shares, warrants, subscription receipts, units, debt securities, or any combination of such securities (collectively, the “Securities”) during the 25-month period that the Shelf Prospectus is effective. The Securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of sale, which will be set forth in a prospectus supplement to be filed.

The Company is filing this Shelf Prospectus to maintain financial flexibility as it advances the development of the Lightning Network but has no immediate intentions to undertake an offering.

The Securities have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the Securities in any State or jurisdiction in which such offer, solicitation or sale would be unlawful.

A copy of the Shelf Prospectus is available on SEDAR (www.sedar.com).

About the Lightning Network

The Lightning Network is a solution to mass scaling the usage of Bitcoin for microtransactions globally, dramatically improving upon fees, as well as instant settlement times. The Lightning Network has experienced explosive growth in the past 90-days with node growth doubling and Lightning Network BTC capacity increasing 51.74%. Some well-known companies such as Jack Dorsey’s Twitter and Square have expressed their enthusiasm to incorporate Lightning Network into their platforms.

About LQwD Fintech Corp.

LQwD is a Lightning Network focused company developing payment infrastructure and solutions. The Company’s mission is to develop institutional grade services that support the Lightning Network and drive improved functionality, transaction capability, user adoption and utility and scaling Bitcoin. LQwD also holds Bitcoin as an operating asset establishing nodes and payment channels across the Lightning Network.

For further information:

Ashley Garnot, Corporate Development

Phone: 1.604.669.0912

Email: [email protected]

Website: www.lqwdfintech.com

Forward-Looking Statements

This news release contains \”forward-looking information\” within the meaning of applicable securities laws relating to the Company’s business plans and the outlook of the Company’s industry. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate, that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. Actual results and developments may differ materially from those contemplated by these statements. The statements in this press release are made as of the date of this release and the Company assumes no responsibility to update them or revise them to reflect new events or circumstances other than as required by applicable securities laws. The Company undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of the Company, LQwD, their securities, or their respective financial or operating results (as applicable).

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

- July 20, 2021

LQwD Appoints Strategic Expert Lightning Network Advisors

Lightning Network focused company, LQwD Fintech Corp. (TSXV: LQWD, OTC: LQWDF) is pleased to announce the appointment of Lightning Network experts Joost Jager and Roy Sheinfeld as advisors to the Company, effective immediately.

Shone Anstey, Chairman and CEO of the Company, commented, “We are very excited to have Joost and Roy join our team at this very timely stage in LQwD’s growth. They are both consummate professionals whose prudence and broad technical insight will be of great benefit to LQwD as we advance our business in the Lightning Network space.”

Mr. Joost Jager is a Bitcoin and Lightning Infrastructure Engineer with a M.Sc. in Computer Science from Radboud University with a specialization in artificial intelligence. Mr. Jager has worked with San Francisco-based Lightning Labs as a lead developer and delivered multiple ground-breaking Lightning features such as hodl invoices, tlv records and probability-based routing. Currently Mr. Jager works with Bottlepay, where he provides Lightning Network expertise for the development of their European focused wallet solution.

Mr. Roy Sheinfeld is a software engineer and the co-founder and CEO of Breez Development Ltd., a privately held Tel Aviv based company that builds interfaces for the Lightning economy. The Breez App is a P2P Lightning Network interface where users can buy, sell, and pay for goods, services, and streaming content with a non-custodial, seamless, and open platform. Previously, he was the Co-founder and CTO of harmon.ie, a company building apps for the Digital Workplace, helping information workers professionals access and collaborate using a variety of leading cloud and on-premises services from Microsoft, IBM, Salesforce, and others.

About the Lightning Network

The Lightning Network is a solution to mass scaling the usage of Bitcoin for microtransactions globally, dramatically improving upon fees, as well as instant settlement times. The Lightning Network has experienced explosive growth in the past 90-days with node growth doubling and Lightning Network BTC capacity increasing 51.74%. Some well-known companies such as Jack Dorsey’s Twitter and Square have expressed their enthusiasm to incorporate Lightning Network into their platforms.

About LQwD Fintech Corp.

LQwD is a Lightning Network focused company developing payment infrastructure and solutions. The Company’s mission is to develop institutional grade services that support the Lightning Network and drive improved functionality, transaction capability, user adoption and utility and scaling Bitcoin. LQwD also holds Bitcoin as an operating asset establishing nodes and payment channels across the Lightning Network.

For further information:

Ashley Garnot, Corporate Development

Phone: 1.604.669.0912

Email: [email protected]

Website: www.lqwdfintech.com

Forward-Looking Statements

This news release contains \”forward-looking information\” within the meaning of applicable securities laws relating to the Company’s business plans and the outlook of the Company’s industry. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate, that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. Actual results and developments may differ materially from those contemplated by these statements. The statements in this press release are made as of the date of this release and the Company assumes no responsibility to update them or revise them to reflect new events or circumstances other than as required by applicable securities laws. The Company undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of the Company, LQwD Financial, their securities, or their respective financial or operating results (as applicable).

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

As the #LightningNetwork continues its rapid growth, comparing it with industry giant @Visa unveils insightful differences. Discover how these payment systems differ in speed, scalability, and cost, explained by LQWD CEO, Shone Anstey.

Watch here-->

#LQWD…

Get our newsletter!

Sign up to download reports and receive breaking news and updates from LQWD Technologies Corp.